Fundamental Outlook: Economic data from Japan see’s a quiet week ahead leaving only Thursday’s BoJ monetary policy meeting standing out. The Bank of Japan is expected to keep monetary policy unchanged at -0.10% while also retaining its QQE purchases. The BoJ is expected to maintain the status quo as the central bank continues to struggle to lift inflation to its 2% inflation target rate. The BoJ will also be giving its forward guidance on when it could reach the inflation target. However, for the most part, the central bank monetary policy meeting is expected to be a non-event. Besides the BoJ meeting, the Japan’s all-industries activity data will be the only other data point in focus amid a quiet week.

Previous USDJPY Weekly Forex Forecast

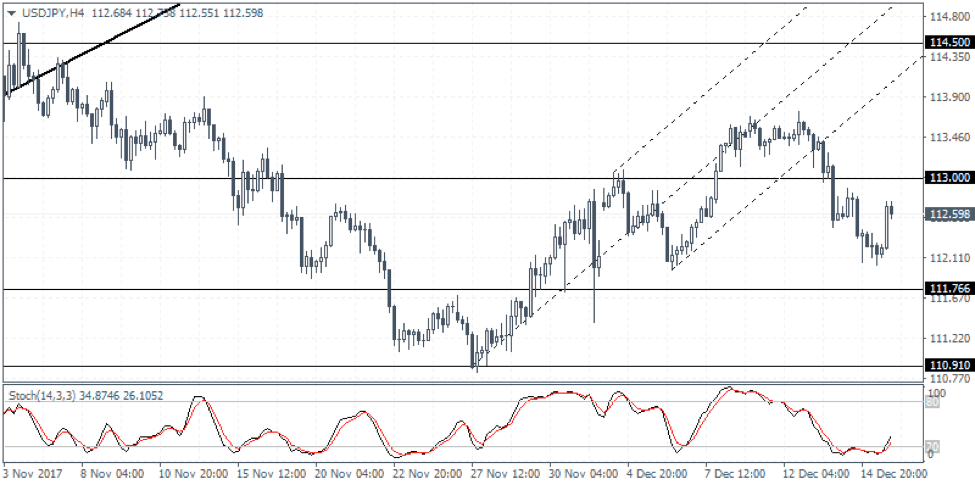

USDJPY Weekly Forex Forecast – 18th to 22nd Dec 2017

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today