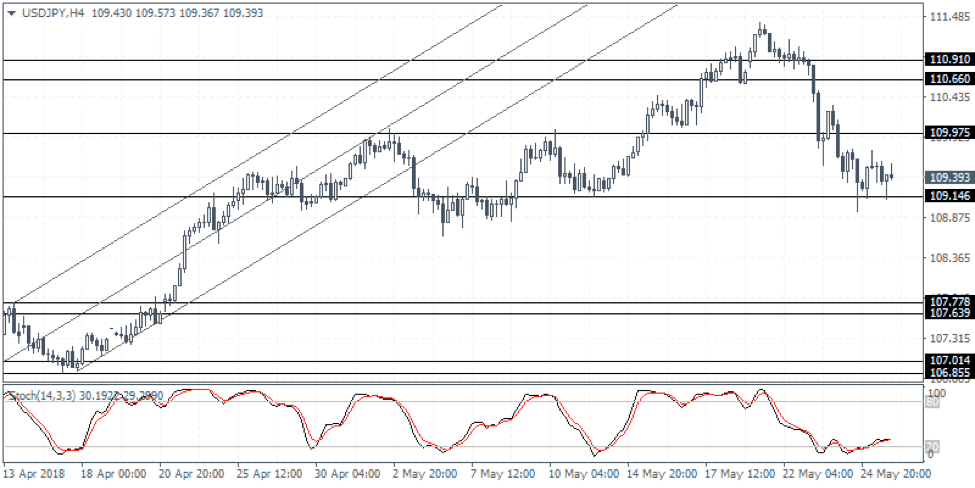

Technical Outlook: The USDJPY currency pair gave up some of the gains as noted from last week’s commentary. Failure to hold out above 110.91 – 110.66 push prices lower. USDJPY cleared the first support at 109.97 and extended the declines down to 109.14. From this level, we could expect USDJPY to potentially correct back to either 109.97 or closer to the breakout level at 110.66. Establishing resistance at one of these levels could signal a bigger move to the downside where the support level at 107.77 – 107.64 could be the next target.

Fundamental Outlook: Data from Japan will see the release of the monthly unemployment report. With inflation staying subdued and the Bank of Japan removing the timeline for achieving inflation target, focus shifts to the bare fundamentals. Retail sales numbers are also due this week which could give an insight into the consumer spending data for the month of April. Other economic indicators include the housing starts and capital spending which could given early glimpses into the GDP developments during the second quarter. The first quarter GDP data from Japan showed that the economy contracted.

USDJPY Weekly Forex Forecast – 28th May to 1st June 2018

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today