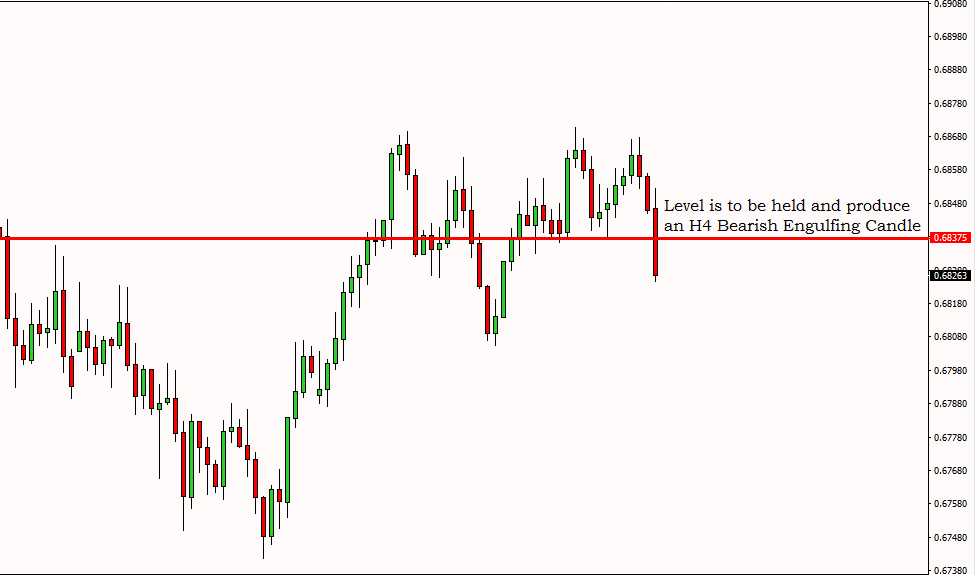

NZDUSD has produced a double top on the H4 chart. The price has breached through the neck of the double top, but it is not an H4 breakout yet. As things seem that NZDUSD would make an H4 breakout at the neck of the double top and after having a consolidation, it would offer a short entry to the sellers. Let us have a look at the H4 chart.

The Super Forex Launcher Trend Reversal System

As we see that the double top and an H4 bearish engulfing candle right at the resistance of the double top drives the price down with good amount of selling pressure. The level of 0.68375 is the neck line here. The last candle is not finished yet. Thus, it must not be counted as an H4 breakout. However, if the breakout takes place, it would look like this. Then, sellers will have to wait for correction/consolidation. The breakout level is to be held and produce an H4 bearish candle to offer a short entry to the sellers. Let us have a look at the summary of the trade

- Sell Order: 0.68375

- Stop Loss: 0.68880

- Take Profit: 0.67875

A breakout is counted once the candle is finished. Before a candle is finished, it does not matter how good the current candle looks, must not be counted as a breakout. A trader, especially at the beginning makes this mistake often. Let us not make this mistake, but be sure about breakout. Different brokers use different timings, but that issue can be solved by following major brokers’ charts.

How I Became a Consistently Profitable Trader

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today