EUR/USD Daily Price Forecast – 24th June 2025

If you like our trade signals, join us on our PREMIUM TELEGRAM CHANNEL.

117% ROI in ONLY 10 days. Join our Facebook Group to learn more.

Trade Summary:

EURUSD

Buy Stop @ 1.16235

TP @ 1.16768

SL @ 1.15673

________________________

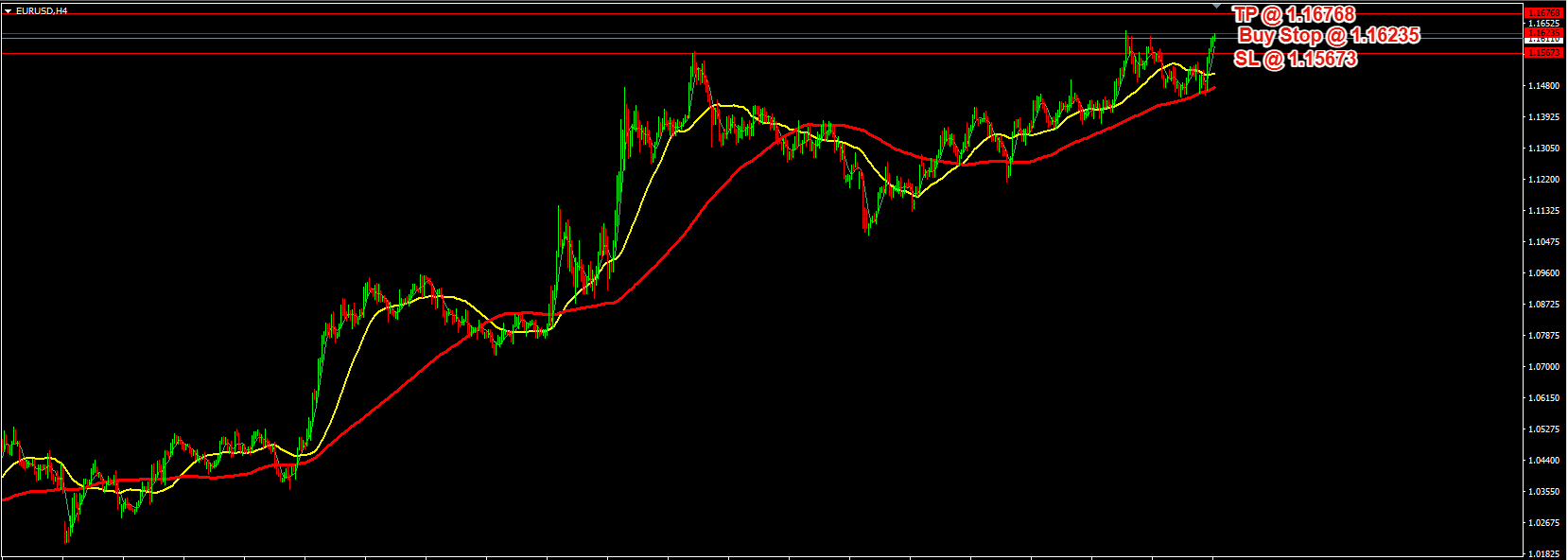

EUR/USD Analysis (H4 Chart)

Key Observations:

Trend Analysis:

The EUR/USD pair is in an uptrend, as indicated by the price consistently trading above the moving averages (yellow and red lines).

The moving averages are sloping upwards, confirming bullish momentum.

Support and Resistance Levels:

Support Level: 1.15673 (Stop Loss level).

Resistance Levels:

1.16235 (Buy Stop level).

1.16768 (Take Profit level).

Entry and Exit Points:

Buy Stop: 1.16235.

Take Profit (TP): 1.16768.

Stop Loss (SL): 1.15673.

Price Action:

The price is approaching the Buy Stop level at 1.16235, indicating a potential breakout above this level.

If the breakout occurs, the next target is the Take Profit level at 1.16768.

Moving Averages:

The shorter-term moving average (yellow) is above the longer-term moving average (red), further confirming bullish momentum.

Trading Strategy:

Bullish Scenario:

If the price breaks above 1.16235, it is likely to continue towards the Take Profit level at 1.16768.

Traders can place a Buy Stop order at 1.16235 with a Stop Loss at 1.15673 to manage risk.

Bearish Scenario:

If the price fails to break above 1.16235 and reverses, it may test the support level at 1.15673.

A break below 1.15673 could invalidate the bullish setup.

Risk Management:

The risk-to-reward ratio for this trade setup is favorable, with a small risk (SL at 1.15673) compared to the potential reward (TP at 1.16768).

Ensure proper position sizing to limit risk to a predefined percentage of the trading account.

Conclusion:

The EUR/USD pair is showing strong bullish momentum on the H4 chart. A breakout above 1.16235 could lead to further gains towards 1.16768. However, traders should monitor the price action closely and adhere to the Stop Loss level to manage risk effectively.

Recommended Lot Size

Trading is all about statistics.

While we can experience winning streaks, we can also suffer from losing streaks.

As such, we should always size each trade to withstand losing streaks (if any).

It’s widely recommended that you should not risk more than 2% of your capital for each trade.

We believe it’s easier to control your lot size by limiting your lot sizing to 0.01 for every $500 in your account.

So if you have $5000, then risk no more than 0.10 lot size per trade.

*****************

If you spot a mistake especially when it comes to the price, please use common sense and check the chart.

We wish you good luck and good profit for this trade idea.

For more trade ideas, join the Price Action Society…

Start with a $30 trading bonus

Trade forex and CFDs on stock indices, commodities, stocks, metals, and energies with these licensed and regulated brokers.

For all clients who open their first real account, these brokers offer a $30 trading bonus to test their products and services without any initial deposit needed.

Learn more about how you can trade over 1000 instruments on their MT4 and MT5 platforms from your PC and Mac, or from a variety of mobile devices.

If you like our analysis and would like to receive 3 to 7 trade ideas per day, then

Click here to learn more about the Price Action Society.

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today