The ADX and RSI strategy might look similar to the ADX and MACD trading strategy. However, unlike the MACD, the RSI can be used to gauge the momentum in prices. When combined with the ADX Indicator, the RSI can act as a great way to compliment the trend strength. Simply put, the ADX and RSI trading indicators when used together can form a powerful way to visual the short term trends in price. This allows for traders to position themselves to enter in a market where the prevailing trend is strong, confirmed by momentum.

The main difference between the MACD and the RSI is that while the MACD is used to time the trade, the RSI is used to time the momentum. Because, when momentum picks up in a trend, chances are that prices will continue pushing higher over a short period of time.

For the ADX and RSI trading strategy, we make use of a 20 period ADX and a 7 Period RSI.

Once the indicators are added onto the chart, you have the following.

ADX and RSI Strategy Chart Setup

ADX and RSI Strategy Trading Rules

Buy Positions:

- DI+ must cross above DI-

- RSI 7 must close above 70

- Buy on the candle close with stops at the low of the candle

- Exit when RSI moves back below 70

Sell Positions:

- DI- must cross above DI+

- RSI 7 must close below 30

- Sell on the close of the candlestick with stops at the high

- Exit when RSI moves back above 30

ADX and RSI Strategy – Trading Examples

Buy Set Up Example

ADX and RSI Strategy: Buy Set Up Example

ADX and RSI Strategy: Buy Set Up Example

- We are alerted to a potential Buy set up as the DI+ crosses above DI-

- Two candles later, the RSI 7 rises above 70

- Long position is taken at the close of this candlestick and stops are placed at the low

- With the RSI oscillating above 70, the long position is held until the RSI dips back below 70, where the long position is exited

- As you can see the RR set up is very reasonable with this trading strategy

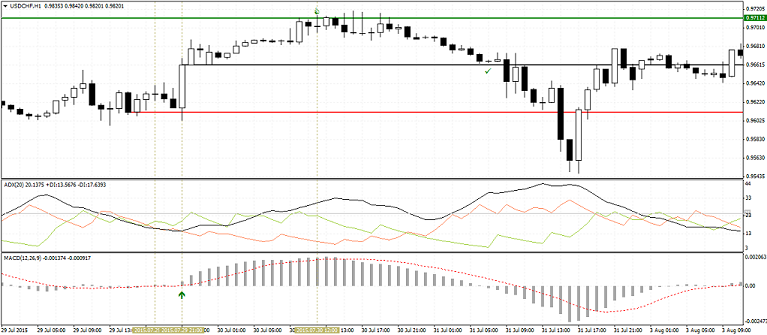

Sell Set up Example

ADX and RSI Strategy: Sell Set Up Example

- We are alerted to a possible short set up when DI- rises above DI+

- A few candles later, the RSI 7 dips below the 30 level and we take a short position at the close of the candle with stops at the high

- Because of the strong momentum, prices trend lower steadily as the short position quickly moves into profit

- We exit the short position when the RSI 7 moves back above 30

ADX – RSI Trading Strategy in Conclusion

As illustrated by the above examples, the ADX and RSI trading strategy is simple and it is easy even for complete beginners. The trading strategy can be used on H1 time frame and above and therefore even day traders can take advantage of this simple trading strategy. The rules are rigid and there is no subjectivity involved and the best part with the ADX RSI trading strategy is the very favorable risk/reward set up that comes with it.

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today