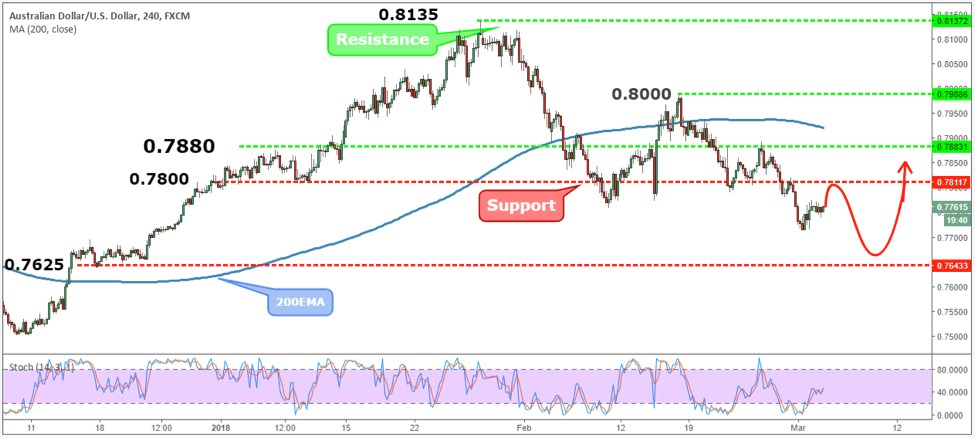

The Aussie has fallen short of reaching our key support level 0.7625 which indicates that after current intraday bounce is over, we can expect another attempt to break lower and possibly find support at 0.7625. On the upside, the first important resistance level remains at 0.7800 followed by the intraday support 0.7880. The line between the bullish and bearish trend remains the big psychological number 0.8000. As long as we trade below it we should expect the bearish momentum to prevail. The stochastic indicator is in neutral territory and it doesn’t suggest any extreme behavior in the overall trend.

The Australian economic calendar comes with plenty of risk events that can disrupt the market volatility. Monday we have the Labour Day so we should expect low level of trading activity. Tuesday, we have one major piece of risk event as the RBA is about to announce its interest rate decision. On Wednesday, the GDP for the last quarter of 2017 will hit the market. On Thursday the Trade Balance are scheduled to be released while Friday will bring the Chinese CPI inflation figures.

Previous AUDUSD Weekly Forex Forecast

AUDUSD Weekly Forex Forecast – 5th to 9th Mar 2018

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today