GBPJPY has been bearish on the H4 chart. Yesterday’s Daily candle came out as a strong bearish candle. It means the sellers are going to wait for consolidation/correction to get ready to go short on the pair again. Let us have a look at the H4 GBPJPY chart.

The Super Forex Launcher Trend Reversal System

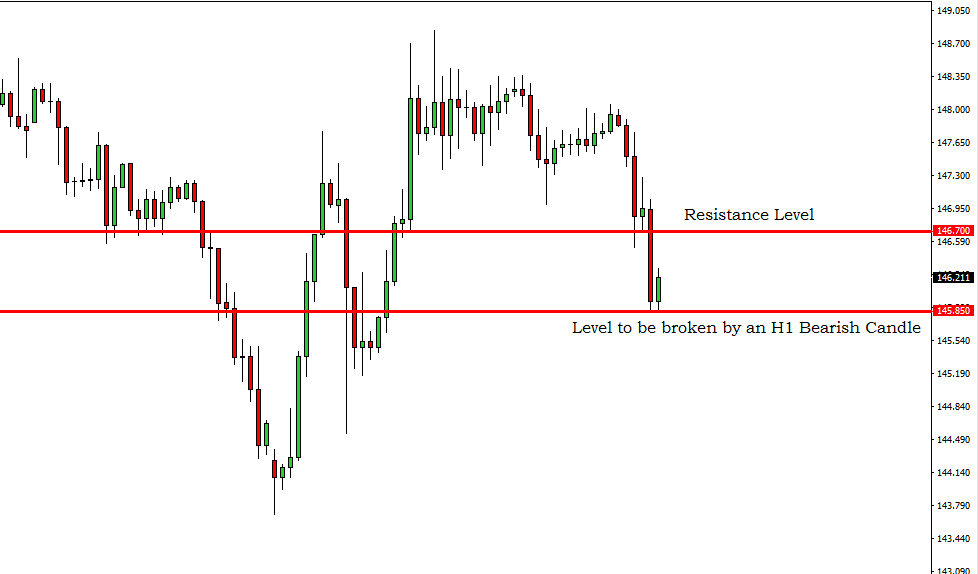

The H4 chart clearly shows that the price has been heading towards the South with good amount of selling pressure. 145.850 is the level which has been acting as the level of support here. On the other hand, the level of 246.700 is the level which might come into play and be the level of resistance. The price has reacted to this level heavily earlier. Now the equation that the sellers would love to get is an H4 bearish engulfing candle near that 146.700 zone and then an H1 breakout at the level of 145.850 to start selling the pair again. Let us have a look at the summary of the trade…

- Sell Stop Order: 145.850

- Stop Loss: 146.700

- Take Profit: 144.550

The USD had a massive bearish move yesterday. FOMC Economic Projections, FOMC Statement, etc made the USD take that bearish move. By looking at the charts such as EURUSD, NZDUSD, AUDUSD and Gold (XAUSD) it seems that yesterday’s move may be very significant in coming weeks. The USD might be heading towards the South by losing its strength. The next week will be a crucial week for the USD to find out whether it would lose its strength for some weeks or not.

How I Became a Consistently Profitable Trader

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today