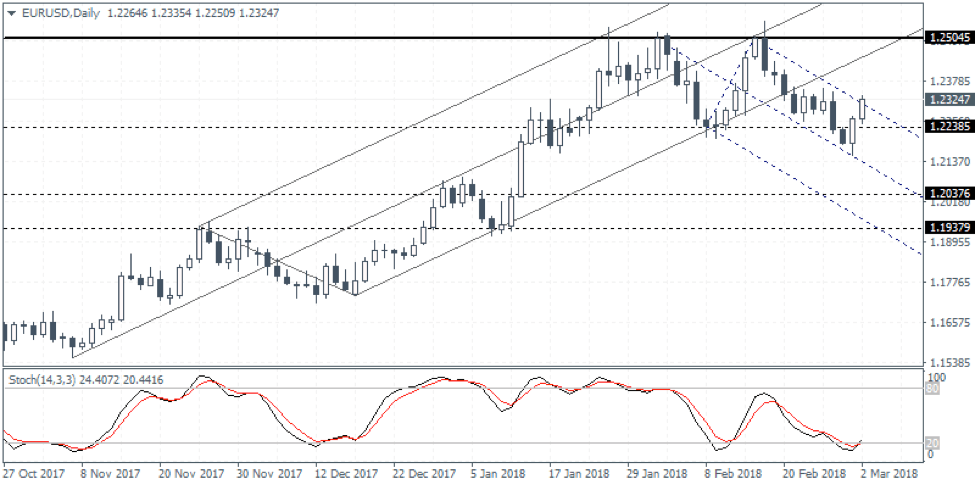

Technical Outlook: The EURUSD has been trading within a range over the past few months with price action consolidating near the 1.246 – 1.2242 level. This strong consolidation has led to the euro currency stalling the gains around 1.2500 region and in the process forming a double top pattern. The short term base has been formed near 1.2238. The bullish reversal following another decline toward the 1.2238 region has led to a short term bounce in the upside. On a monthly basis, we expect the EURUSD to post declines for a much needed correction. Most of this will depend on the fundamentals of course. Watch for a break down in the EURUSD below 1.2238 level of support which could signal a decline toward 1.2037 followed a brief decline toward 1.1938.

Fundamental Outlook: Following a strong start in the month of January and February, the EURUSD is expected to take a breather. The main event risk will be the Italian elections due this Sunday and the ECB meeting. With inflation easing back, ECB officials are likely to tread carefully and keep the market expectations in check. Hawkish undertones from the ECB could potentially give way for further gains in the euro currency which could potentially weaken the pace of inflation increases. With the Federal Reserve expected to hike rates in March, we expect to see some near term weakness in the euro currency which could become a buying opportunity in the long term bullish trend that is emerging.

Previous EURUSD Monthly and Weekly Forex Forecast

EURUSD Forex Forecast for March 2018

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today