GBP/USD Daily Price Forecast – 15th September 2025

If you like our trade signals, join us on our PREMIUM TELEGRAM CHANNEL.

117% ROI in ONLY 10 days. Join our Facebook Group to learn more.

Trade Summary:

GBPUSD

Buy Stop @ 1.35744

TP @ 1.36636

SL @ 1.35364

________________________

GBPUSD: Breakout Watch Above 1.3575 – Setup, Levels, and Trade Plan

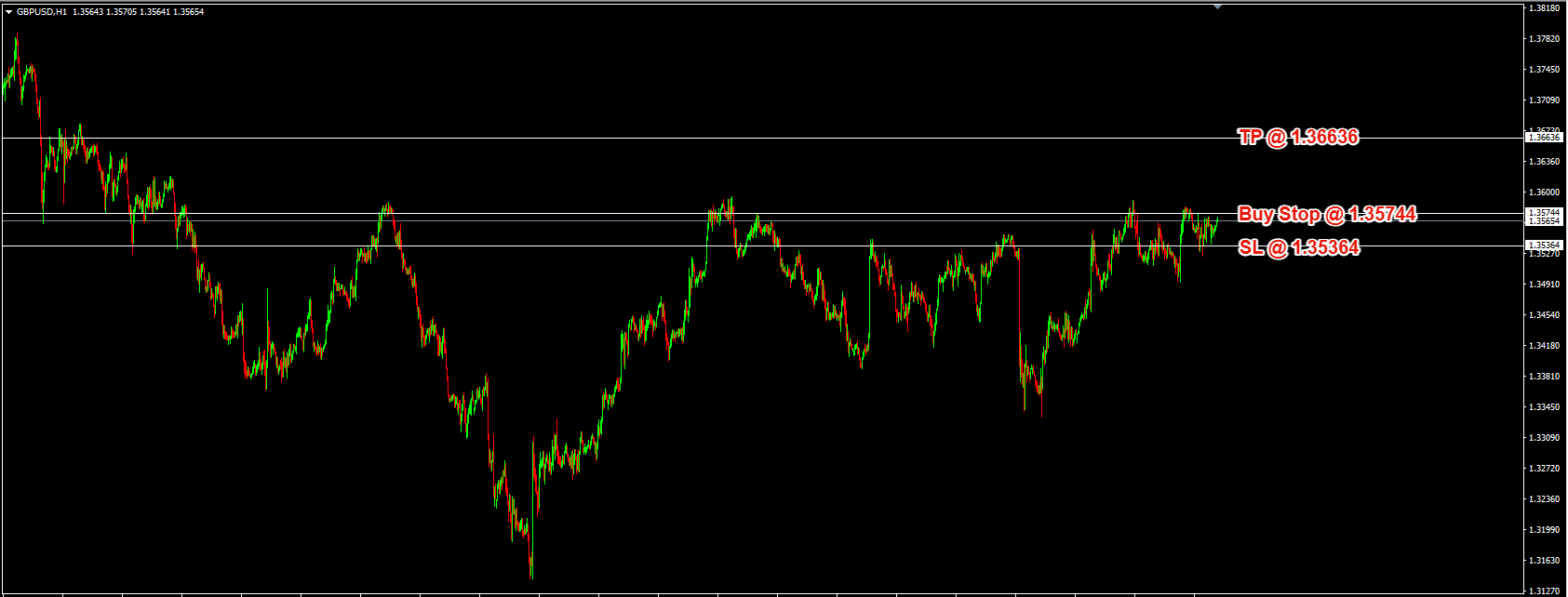

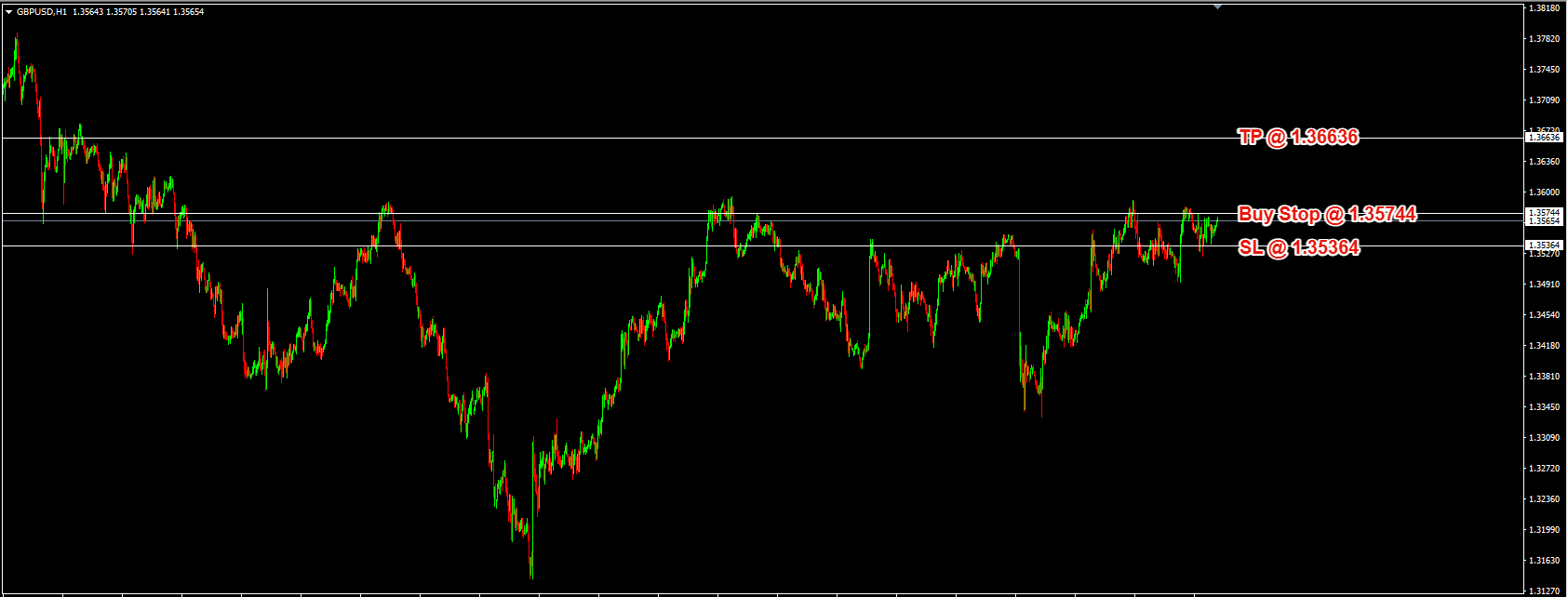

Overview GBPUSD has carved out a constructive H1 structure after recovering from recent swing lows. Price is compressing just beneath a well‑defined resistance shelf at 1.3575–1.3600, forming a flat‑top/ascending consolidation. Repeated tests of the ceiling without deeper pullbacks suggest building upside pressure.

Chart

Key Technical Levels

Immediate resistance: 1.3575–1.3600 (multi‑touch cap; breakout trigger zone)

Near‑term support: 1.3530–1.3540 (range base and last higher‑low cluster)

Psychological support: 1.3500

Deeper support: 1.3460–1.3475 (prior pivot)

Overhead supply/first target: 1.3655–1.3670 (prior congestion)

Trade Idea (Breakout Strategy)

Entry: Buy stop at 1.35744 (above the range top to catch momentum)

Stop loss: 1.35364 (below range base/invalidates bullish thesis)

Take profit: 1.36636 (into next supply band)

Approximate risk–reward: ~1:2.3 (about 38 pips risk for ~89 pips potential)

Why This Setup Works

Structure: Flat‑top consolidation with higher lows = pressure building under resistance.

Liquidity: A push through 1.3575 likely runs stops and invites breakout flows toward 1.3655+.

Validation: SL sits below the last defended demand; a break beneath 1.3530 signals the range failed.

Confirmation Checklist

H1 close above 1.3575–1.3580 or a swift impulsive break with rising momentum.

Best timing historically: London open and London–New York overlap.

Data risk: Avoid initiating directly into tier‑1 releases to limit slippage/fakeouts.

Trade Management

If triggered and price holds 1.3575–1.3580 on a retest, consider:

Moving SL to breakeven once price sustains above 1.3590–1.3600.

Partial profit at 1.3625–1.3640 (intermediate reaction area), let the remainder run to 1.3663.

If price spikes above 1.3575 and closes the hour back inside the range, watch for a bull trap; a drop back under 1.3560 can unwind toward 1.3540.

Bearish Alternative

An H1 close below 1.3530 turns the current range into distribution.

Downside opens to 1.3500, then 1.3460–1.3475.

Invalidation for shorts: Reclaim and close back above ~1.3575.

Position Sizing Example

With a 38‑pip stop, risking 1% on a 10,000 USD account (~$100 risk):

$100 / 38 pips ≈ $2.63 per pip ≈ 0.26 standard lots on GBPUSD (1 lot ≈ $10/pip).

Adjust to your account size and risk tolerance.

Macro and Flow Considerations

USD side: Moves in US yields and the broad dollar index can cap or fuel breakouts.

GBP side: BoE guidance and UK CPI/wages prints influence direction.

Risk sentiment: Equities/credit tone; risk‑on generally supports GBP.

Event risk: UK CPI/GDP/labor, US CPI/PCE/NFP/Fed speakers. Plan entries around these to reduce volatility surprises.

Bottom Line The bias is constructive while 1.3530–1.3540 holds. A clean H1 breakout above 1.3575 favors continuation into 1.3655–1.3670. The outlined setup offers attractive risk–reward if momentum confirms—manage actively on a successful retest and stay disciplined if the breakout falters.

Recommended Lot Size

Trading is all about statistics.

While we can experience winning streaks, we can also suffer from losing streaks.

As such, we should always size each trade to withstand losing streaks (if any).

It’s widely recommended that you should not risk more than 2% of your capital for each trade.

We believe it’s easier to control your lot size by limiting your lot sizing to 0.01 for every $500 in your account.

So if you have $5000, then risk no more than 0.10 lot size per trade.

*****************

If you spot a mistake especially when it comes to the price, please use common sense and check the chart.

We wish you good luck and good profit for this trade idea.

For more trade ideas, join the Price Action Society…

Start with a $30 trading bonus

Trade forex and CFDs on stock indices, commodities, stocks, metals, and energies with these licensed and regulated brokers.

For all clients who open their first real account, these brokers offer a $30 trading bonus to test their products and services without any initial deposit needed.

Learn more about how you can trade over 1000 instruments on their MT4 and MT5 platforms from your PC and Mac, or from a variety of mobile devices.

If you like our analysis and would like to receive 3 to 7 trade ideas per day, then

Click here to learn more about the Price Action Society.

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today