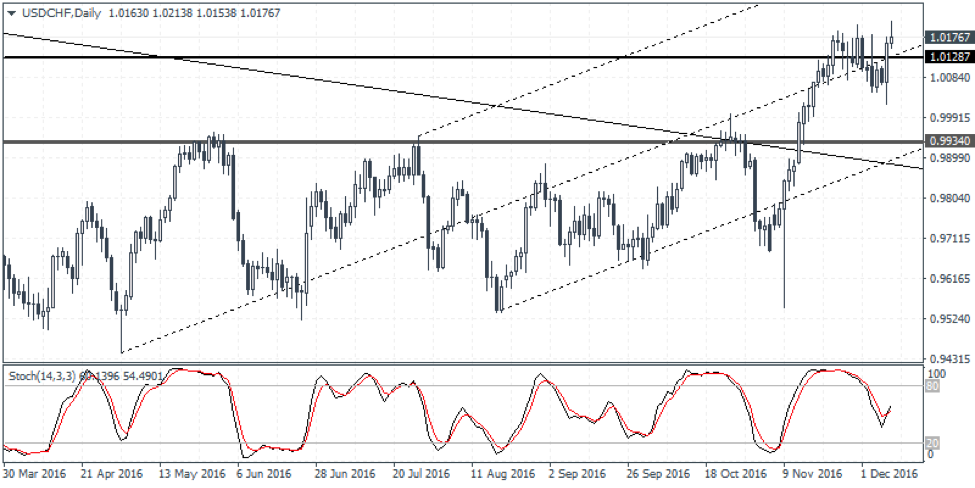

Technical Outlook: USDCHF has been posting a strong consolidating near 1.0128 with prices turning volatile around this level. The failure to post any significant highs on consecutive rebounds hints at a potential move down to 0.9934. Given that the SNB and the FOMC meetings are due next week, it is best to look for long positions on the dip to 0.99340 support level, targeting 1.0128 and eventually to 1.0225. In case of the support failing at 0.9934, USDCHF could be looking at extending declines towards 0.9827.

Fundamental Outlook: The Swiss franc will be looking at a double whammy as the FOMC and the SNB meetings are lined up this week. While the Fed’s decision comes first, later in the week on Thursday, the Swiss national bank will be announcing it quarterly monetary policy statement. There are no changes expected as the central bank will maintain its -0.75% interest rates. Latest forex figures showed that the SNB has been actively engaged in the forex markets to weaken the Swiss franc and the quarterly monetary policy meeting is likely to see the central bank reinforce its commitment to keeping the Swiss franc weaker.

Previous USDCHF Weely Forex Forecast

USDCHF Weekly Forex Forecast – 12th to 16th Dec 2016 – Bearish

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today