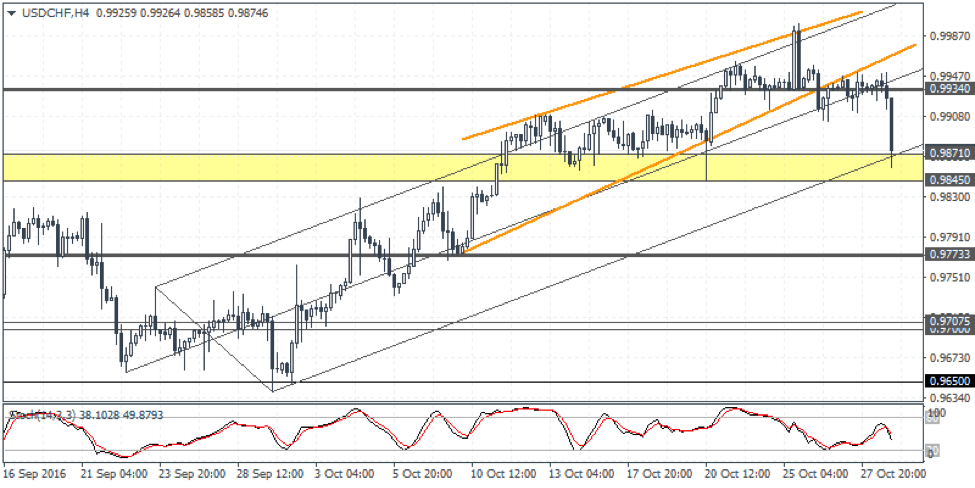

Technical Outlook: USDCHF broke through the rising wedge pattern after a brief consolidation near 0.9934 resulting in a sharp decline to the lower median line and the major support zone sitting at 0.9871 – 0.9845. This could offer some short term support to prices as USDCHF is bound to retrace the declines. As long as the rebound from 0.9871 – 0.9845 forms a lower high below 0.9934, the bias remains to the downside targeting 0.9871, 0.9845 and eventually to 0.9773. This bearish scenario will be invalidated on a daily close above 0.9934 which will then see further upside with USDCHF likely to post new highs.

Fundamental Outlook: Data from Switzerland is relatively quiet in comparison to the US data. ISM manufacturing is expected to remain broadly flat although an upside surprise could see the US dollar gain against the Swiss franc. Friday’s nonfarm payrolls will be the second report ahead of the December FOMC meeting. Therefore an improvement in the jobs could be seen as positive, reinforcing expectations for a December rate hike which could be priced in.

USDCHF Weekly Forex Forecast – 31st Oct to 4th Nov 2016 – Mildly Bearish

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today