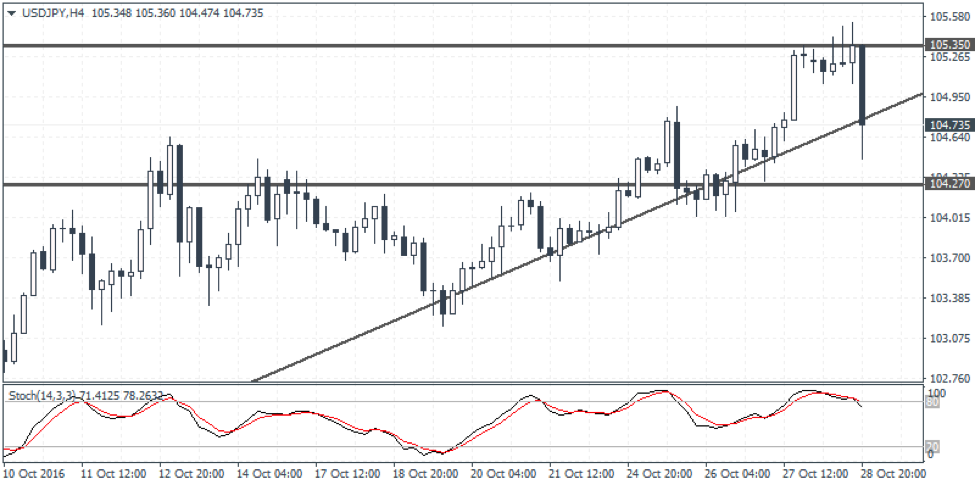

Technical Outlook: USDJPY was bullish last week and the bearish scenario mentioned last week was invalidated after a daily close above 104.27. The momentum to the upside is however showing signs of easing but price could remain range bound. Next week’s high impact central bank meetings will no doubt keep USDJPY very volatile. Further upside can be expected on a close above last week’s higher close at 105.35. The trend line, which has been well respected remains in focus as a potential break out from the trend line could trigger some near term downside. Watch for a bounce off 104.27 support initially as USDJPY is sure to attempt to rebound to the upside. Look for price to make a lower high below 105.35 and then short targeting 104.27 followed by 102.50.

Fundamental Outlook: The main event for USDJPY will be the Bank of Japan’s monetary policy meeting. No changes are expected from the BoJ at this week’s meeting but forward guidance for December’s meeting will be key. After the September BoJ meeting saw new inflation targeting methods being unveiled, the Bank of Japan’s event will be overshadowed by the FOMC meeting where interest rates are likely to be kept unchanged ahead of the US elections a week from now.

USDJPY Weekly Forex Forecast – 31st Oct to 4th Nov 2016 – Mildly Bearish

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today