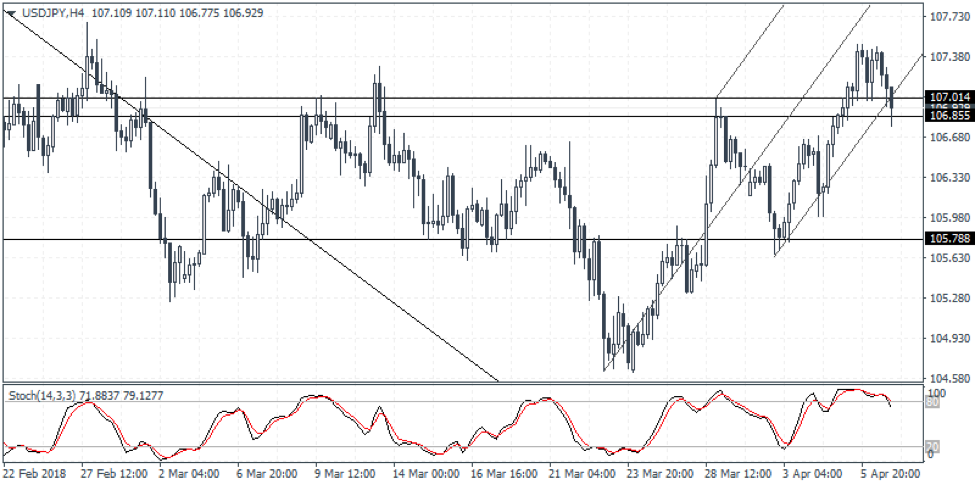

Technical Outlook: The USDJPY currency pair rallied to a five week high last week as price action traded briefly around the 107.00 level. The U.S. dollar was seen giving up the gains rather promptly. However, price action is seen supported near the price level of 107.00 – 106.85. If this support level holds, then we expect USDJPY to turn to the upside with renewed momentum. Resistance at 108.34 will be the most likely upside target. Alternately, a close below the current support level could signal a decline toward the 105.78 handle.

Fundamental Outlook: Data from Japan this week will start off with the consumer confidence report due on Monday. Later in the week, the preliminary machine tool orders will be coming out followed by the core machinery orders report on Tuesday. It is a relatively light week as far as the Japanese yen is concerned. However, the yen could be seen reflecting the ongoing uncertainty especially in regards to trade pacts between the U.S. and China. The market sentiment is likely to remain cautious and this could reflect in the Japanese yen that could continue to strengthen as the market’s risk appetitie wanes.

Previous USDJPY Weekly Forex Forecast

USDJPY Weekly Forex Forecast – 9th to 13th April 2018

Claim Your $60 No Deposit Bonus Here

All you need is to have your live account verified!

Of course, you need to open a live account...

2 Brokers that we like A LOT!

USD30 from each Forex Broker Below.

Both Forex Brokers have excellent rating!

We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies.Other Analysis Today